Call to speak to our team

Contact our team via email

Mon - Fri: 8:00 - 4:30

We maintain normal hours

Call to speak to our team

Contact our team via email

Mon - Fri: 8:00 - 4:30

We maintain normal hours

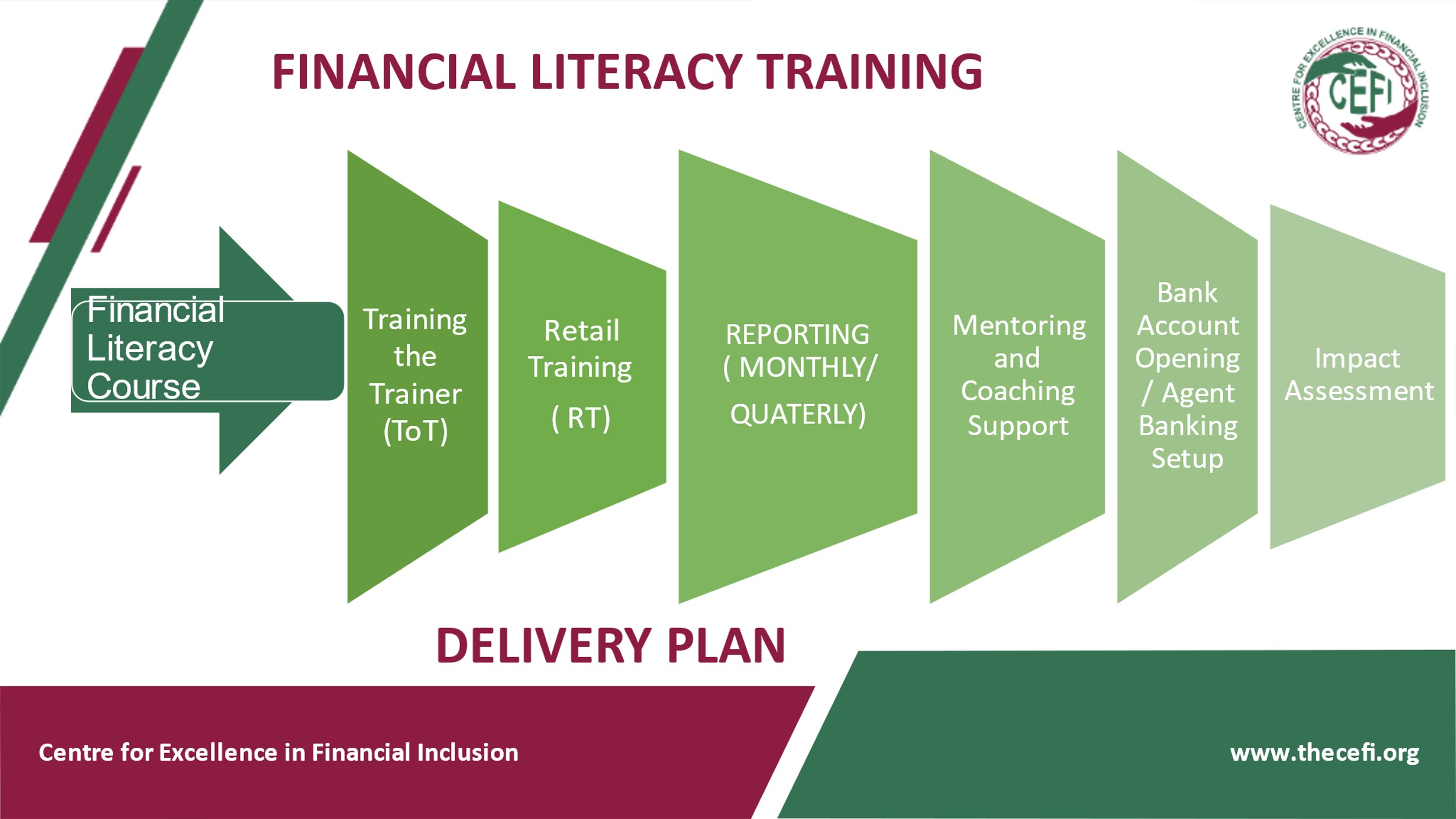

As of December 2021, 237,406 Papua New Guineans received financial literacy training of whom 47% trained were women. The financial literacy trainings focused on the ability to understand and effectively use various skills, including personal financial management, budgeting, and investing. CEFI took lead role in conducting trainer-of-trainers (TOT) programs for financial literacy and created a pool of 1,011 qualified trainers of whom 368 are women distributed across PNG. CEFI has played an important role to coordinate various financial literacy initiatives in PNG. Financial institutions and other development agencies have also implemented financial literacy initiatives as part of their corporate social responsibility programs or marketing efforts. CEFI registered 39 financial literacy training providers that comprise of non-government organizations, financial institutions, church organizations and government agencies. An MOU was signed with Department of Education to integrate financial education to the curriculum for preparatory level up to grade 12 students in the country. The curriculum development is in progress with the objective of educating school children about money management, income generation, savings and budgeting, investments, and credits. CEFI is in discussion to partner with the PNG National Training Council (NTC) to ensure financial literacy training providers in PNG are accredited by CEFI to provide financial education/ literacy training in PNG.

An Instructional System Design (ISD) Framework was adopted to strategically design and implement and monitor FL the program.

Participatory and Behavior Change Approach were used to developed training sessions in consultation with the ISD Framework.

The Journey to ‘Financial Freedom’ starts with Financial Literacy (FL). Financial Literacy is a fundamental financial management tool, if used correctly, it has the ingredient to empower people in a greater extend by revolutionizing financial behavior patterns and improve livelihoods.

Financial Literacy in Papua New Guinea (PNG) was birthed through CEFI’s collaborative efforts with Microfinance Expansion Project and Bank of Papua New guinea , aimed at empowering and Papua New Guineans understand and know how to access, financial services for personal or business use.

Acquiring knowledge on financial literacy creates deeper access for understanding to use the knowledge by knowing how to access financial services for personal consumption or business driven initiatives.

Centre for Excellence in Financial Inclusion has developed six (6) financial literacy module in consultation with international best practices for financial literacy training.

The Module includes:

After delivering , monitoring and accessing the impact of Financial literacy Trainings in PNG for the past 9 years , it has enabled CEFI to conclude that yes more lives has being transformed, however, the demand for FL in PNG is still high.

Papua New Guineans are smart in generating income but lack ‘‘Cash Management Techniques”.

This is due to varies reasons, but there are 7 major reasons identified by CEFI:

With FL tools it enables one to see the importance of ”Cash Management” The FL tools include:

Milestones

FL journey with CEFI began in 2013 and has a long way, many milestones achieved. Here are the details:

Challenges

Papua New Guineans are equipped with FL tools to take control of their money, but, there are still challenges.

Lesson Learnt

The lesson learnt from CEFI’s engagement:

Outcomes

Behavior Change Champions – 55 case studies were developed using the impact assessment tools in the 4 regions. This concludes that after attending the FL trainings 48 % of 217,630 persons behavior towards money changed.

More people are now:

Obligations;

CEFI’s key role is to coordinate, advocate and monitor financial inclusion activities including coordinating stakeholder dialogue towards responsible financial service delivery and service quality, encourage innovation and strengthen financial sector industry development.

Head Office:

Third Floor, Credit Corporation Building, Cuthbertson Street, Port Moresby

Phone: +675 322 5300

Email: info@thecefi.org