- Tell us a bit about Centre for Excellence and Financial Inclusion.

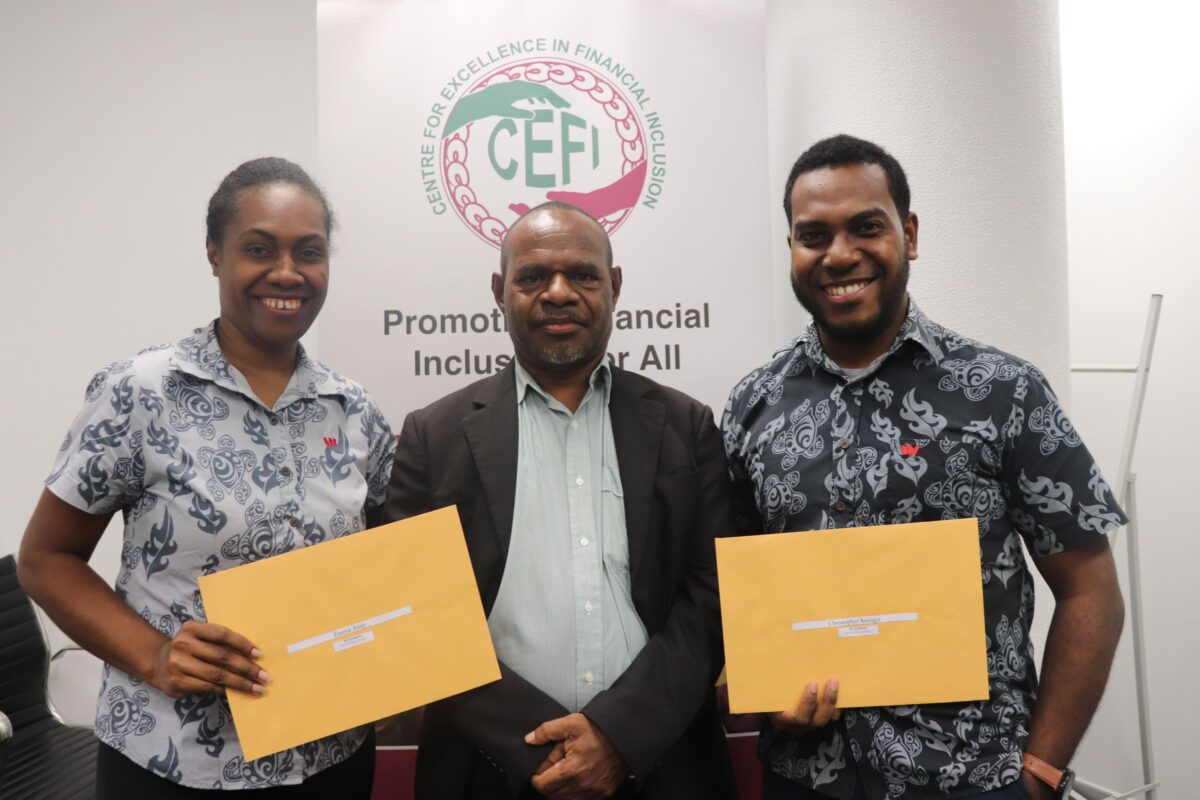

CEFI was launched in April 2013, registered as an Association incorporated under PNG law and officially launched on 24th April, 2013 by the Hon Peter O’Neill. Members of the association include the Bank of PNG and Department of Planning and Monitoring. The board members consist of the Department of Treasury and the Department of Community Development, representatives from Commercial Banks, Micro Banks, Savings and Loan Societies and the Institute of Banking and Business Management (IBBM). CEFI was endorsed by PNG’s National Executive Council as the industry apex organisation mandated to coordinate, advocate and monitor all financial inclusion activities in PNG. In this capacity, CEFI has drafted and implemented two national financial inclusion strategies(NFIS 2014-2015 and NFIS 201602020) and is currently drafting the 3rd National Financial Inclusion Strategy 2022-2016. It envisages creation of a robust financial sector which will reach people across the country and ensure all Papua New Guineans are financially competent and have access to a wide range of financial services that address their needs and are provided in a responsible and sustainable manner. CEFI’s mission is ‘Creating Financial Freedom’ that is to promote excellence in financial services, innovate delivery channels and facilitate financial education.

- What is financial inclusion?

Financial inclusion refers to individuals and businesses having access to and effectively use affordable financial products and services that meet their needs – payments, savings, credit and insurance – which are delivered in a responsible and sustainable way.

CEFI recognises that expanding financial services can encourage the participation of more Papua New Guineans, especially those in rural areas and urban settlements, in income generating activities in both the formal and informal sectors of the economy, and become part of the formal monetised economy thereby contributing meaningfully to the growth of the economy.

- Why is financial inclusion important?

Financial inclusion is important in the Papua New Guinea (PNG) context as 75% of the adult population do not have access to formal financial services. Difficult geographies, lack of physical and social infrastructure, limited technological skills and know-how has created difficult challenges in the supply and access of financial services. As a result a large portion the low-income population, in particular rural people and mostly women are financially ‘excluded’, meaning they lack access to basic financial services.

Consistent with the PNG Government’s Vision 2050 for Wealth Creation, financial inclusion aims to ensure all people regardless of status, age and gender have access to a wide range of quality financial services, provided to them at affordable prices, in a convenient manner, and on a sustainable basis.

- What are the successes of CEFI from implementing the first financial inclusion strategies?

Since the launch and implementation of the two National Financial Inclusion Strategies, unprecedented progress in financial inclusion has been achieved. As at March 2022 an aggregate of 3.6 million deposit accounts were held at regulated financial institutions with 1.2 million accounts belonging to women representing 33%. This is an increase of 2.5 million new accounts from 1.1 million accounts by December 2013. Financial access points in the country have grown by 56% in the last three years.

Papua New Guineans can now access the formal financial sector over 13,000 physical access points, as well as often via their mobile phones. In addition, Microinsurance has also been introduced in the country to reach remote communities.

Achievement and milestones achieved in the 1st National Financial Inclusion Strategy (2013-2015):

- 1,187,024 new bank accounts opened – 462,939 ; 35% were women

- 124,375 people reached with financial education ; 47% were women

- 67 new branches, 73 ATMs, 4959 EFTPOS and 233 new agents added onto the financial service network on total 12,599 service outlets

- 696,792 policy holders have taken out micro-insurance products

- 315,993 people now linked their deposits account with Mobile Phone banking.

- Equal access of financial services for women is one of the organization’s core objectives. Do you have specific targets you wish to achieve in regard to that objective?

Despite the achievements ,a majority of the population especially the vulnerable that includes women continues to lack access to formal financial services. It is more prevalent in rural communities, among women and microenterprises, especially those within the informal economy and in agriculture. Therefore, financial exclusion remains a fundamental challenge.

Nearly one of every three women in the world — or 1.1 billion — is excluded from the formal financial system. Globally, women are 7 percent less likely than men to have basic transactional accounts, and this disparity rises among the poor.

Women appear to have significantly lower levels of financial inclusion, even where financial services are available in urban communities. The scale of women’s financial exclusion in PNG makes it the need to focus on women. But this is not an easy task. Expanding access to finance for women brings some unique challenges. Socio-cultural factors, limited financial and/or functional literacy, lower levels of formal education and limited familiarity with formal financial institutions may be factors why women are likely to have lower levels of financial inclusion and engagement in household financial decision making. Further research is required to develop an understanding of the causal factors which can then provide a basis for gender specific programs and products.

The 2nd National Financial Inclusion Strategy 2016-2020 aimed to expand access to financial services to a further 2 million of PNG’s population of which 50% are women and also work with financial service providers in the country to provide products tailored to the needs of clients as it is clear that in particular, women and rural communities and MSMEs -including agricultural- suffer from the lack of products tailored to their needs, including access to credit.

Earlier this year, a Gender Equity and Social Inclusion (GESI) Policy for Microfinance Institutions was launched the Asian Development Bank (ADB), the Governments of Australia PNG and CEFI. The GESI policy was developed to help build and champion gender equity and social inclusion values and principles for MFIs.

CEFI believes that providing low-income women with effective and affordable financial tools to save and borrow money, make and receive payments, and manage risk is critical to both women’s empowerment and poverty reduction. However, the path to greater women’s financial inclusion is dependent upon the creation of a more gender inclusive financial system that addresses the specific demand- and supply-side barriers faced by women, supported by an inclusive regulatory environment.

6. What are the significant challenges in providing financial literacy services especially to rural areas?

At the outset, financial literacy is a means to financial inclusion, that is, financial literacy could play an important role in enabling the most vulnerable segments of the population to use appropriate financial services. The main challenges or concern in delivering financial literacy in PNG rural areas is the high level illiteracy and demographically issolated communication limited or no government support . I

CEFI is in the process of reviewing its financial literacy courses and curricula so it’s tailored to the different segments of the community to improve their financial skills and knowledge. Such programmes should promote their awareness of available financial products and services and enable them to make appropriate choices of these services.

7. Recently a senior economist from Westpac Bank highlighted that the access to affordable financial credit was impeding the growth of businesses in PNG. Similar sentiments were shared by Commerce, Trade & Industry minister, Wera Mori at the inaugural SME Expo. Mori said lack of financial capital has slowed the growth of SMEs in PNG. What is CEFI’s position in this regard?

CEFI agrees with those viewpoints. In fact, the 2nd Financial Inclusion Strategy (NFIS) seeks to align with and complement the initiatives implemented under the SME Policy 2016 and has SME finance as a key priority area under the new strategy. Small and Medium Enterprises (SMEs) play a major role in most economies, particularly in developing countries. They often employ a larger proportion of the population than larger enterprises and are therefore vital for inclusive economic growth. In PNG, SMEs already make a major contribution to national output, accounting for 200,000 jobs and an estimated 10% of GDP (though these figures are likely much higher if the informal sector is taken into account). Longer term, the government aims to increase the sector’s share of GDP to 50%. At present, SMEs face obstacles to financing and are often perceived as high-risk by commercial lenders. According to local media reports, 94.4% of SMEs in PNG have never received a loan and just 2.5% had benefitted from direct government assistance.

Due to the importance of SMEs for inclusive growth in PNG, CEFI and stakeholders decided to include this new Priority area: SME Finance: that is, focused on enhancing access to and usage of finance by SMEs. Activities include: Enhance knowledge and data on financial inclusion among SMEs; Review regulatory and supervisory frameworks to ensure they are fully enabling for SME Finance ; Promote innovation and competition in SME Finance; Facilitate dialogue on existing public sector interventions and support schemes and Strengthen capacity of SMEs and financial institutions.

8.We understand that CEFI has since launched two Financial Inclusion Strategies (NFIS) 2014-2015 and NFIS 2016-2020. What are some lessons from these two strategies?

As is the case in most countries in the world, the financial sector landscape is changing the fact remains that we have made significant progress to date and also learnt some lessons. Important lessons learnt are:

- Networking and collaboration amongst all stakeholders is important.

- Improve Financial Literacy / Education and Financial Competency Levels for Papua New Guineans.

- Provincial and Local Level Government involvement.

- The need to set Financial Inclusion targets for financial service providers.

- Budgeting limitations and constraints.

9.What is CEFI looking to achieve with the second strategy?

The public-sector goal is for financial inclusion to enable individuals and businesses to achieve their economic potential, i.e. to support economic development, increase incomes and improve the standard of living (impact). For the private sector, the goal is to acquire new customers, access new market segments and ultimately increase profits. The 2nd strategy will look at improving the 4 key pillars detailed:

Enabling environment: that is, the policy, legal and regulatory framework. Important advancement to translate policy goals into a fully enabling environment for innovative financial inclusion. There is a need to finalize long-term regulatory framework for digital financial services; Need for demand-driven roll-out of National Payment Switch; Need to strengthen financial consumer protection as industry matures; Need to introduce a comprehensive regulatory framework for micro-insurance and the need for development partner support to catalyze further innovation and address capacity building needs.

Physical access points: Lack of financial access points, in particular in rural areas, continues to constitute a key barrier to financial inclusion in PNG. There is: 1) Need to increase physical access points in rural areas and 2)Need to exploit the potential of digital financial services to expand the reach of the formal financial sector

Quality: Need to further enhance product tailoring, in particular for excluded individuals and Businesses; Need to reduce reliance on cash; Need to further promote competition in order to reduce prices

Usage: Access and quality are both preconditions for effective and large scale usage of financial services. Financial literacy, competency and consumer awareness must be strengthened to drive usage