Port Moresby, Papua New Guinea, March 25, 2024. The Bank of Papua New Guinea (BPNG) in close collaboration with the Global Green Growth Institute (GGGI) together with other key partners including the Centre for Excellence in Financial Inclusion (CEFI), the Department of Climate Change and Development Authority (CCDA), the Department of Treasury, the Alliance for Financial Inclusion (AFI), the New Zealand Ministry of Foreign Affairs & Trade (NZ MFAT) and the Agence Française de Développement (AFD) all gathered at the Hilton Hotel to launch Papua New Guinea’s Green Finance Centre (GFC).

GGGI, as the main delivery partner and CEFI as a champion in financial inclusion teamed up to develop the Inclusive Green Finance Policy (IGFP) back in 2021. GGGI received a total funding of USD 670,000 from the New Zealand Ministry of Foreign Affairs and Trade (MFAT) under the Low Emission Climate Resilient Development Program (LECRD) program for the initiative which includes the establishment of the GFC.

The GFC will now serve as the entity responsible for overseeing the implementation of IGFP and all future initiatives related to green finance flows in the country. Its core objective would be to address environmental and climate challenges in PNG and promote sustainable economic growth through innovative, yet inclusive climate financing and green investment mechanisms and it will be guided by a steering committee that is chaired by BPNG.

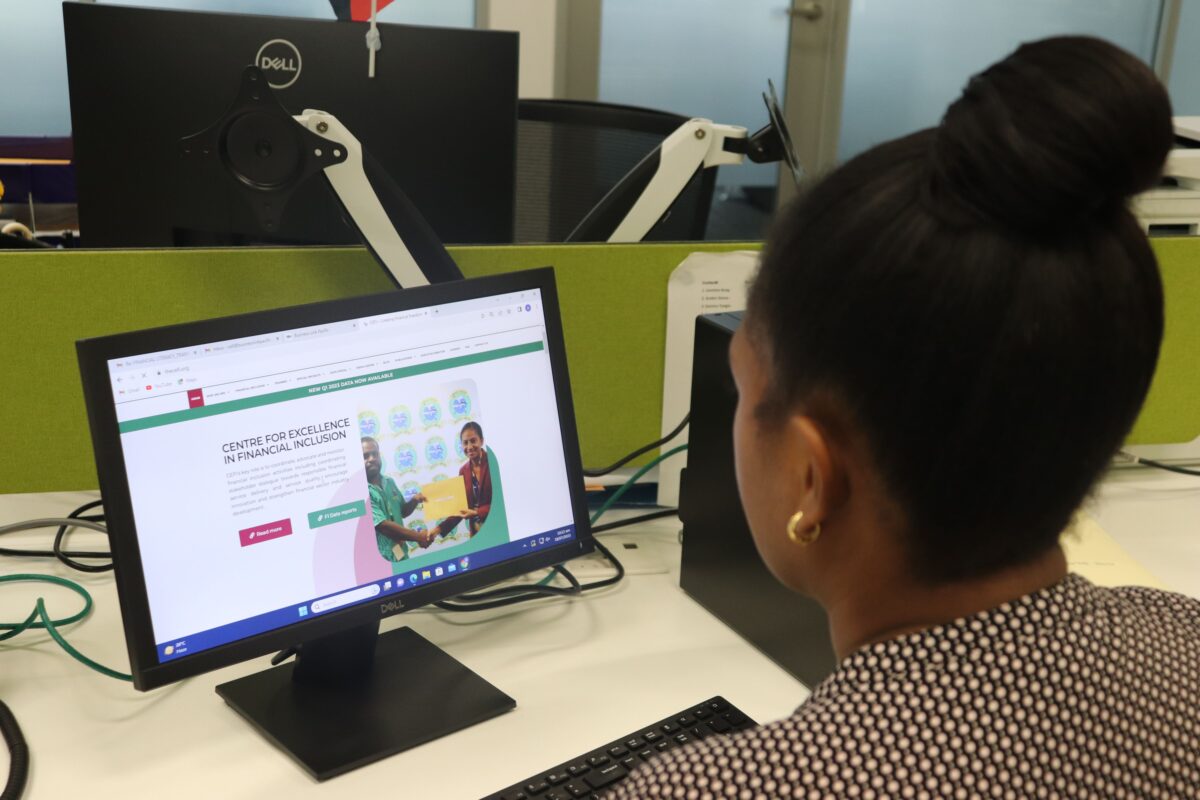

During the launch, GFC’s logo and website were unveiled by the guest of honour, Chief Secretary to the Government of Papua New Guinea Mr. Ivan Pomaleu OBE, Conservation Environment & Climate Change Minister Hon Simo Kilepa MP, and the Governor of the Bank of Papua New Guinea Mrs. Elizabeth Genia.

Other high-profile guests who were present at the auspicious launch included New Zealand High Commissioner to PNG, HE Pete Zwart, France Ambassador to PNG, HE Guillaume Lemoine, GGGI Country Representative Mr. Sakiusa Tuisolia, AFD Executive Director Mr. Philippe Orliange, AFI Executive Director Dr Alfred Hannig, BPNG Assistant Governor Mr. George Awap and CEFI Chief Executive Officer Mr. Saliya Ranasinghe.

Coinciding with the launch was the signing of a Memorandum of Understanding (MoU) among BPNG, GGGI and the three financial Institutions; Bank of South Pacific Group (BSP Group), Nationwide Mirco Bank (MiBank) and Women’s Micro Bank (Mama Bank) to integrate the IGFP onto their books to develop green loan products.

Also at the launch, AFD signed a 6 million Euros grant agreement with GGGI as the delivery partner of Greening the Pacific’s Financial System. Under this grant, PNG through the GFC will receive 1 million Euros to support the ongoing work of IGFP implementation and an additional 1.8 million Euros for designing and capitalizing of a Green Refinancing Facility.

The guest of honour in his keynote remarks praised the establishment of the GFC that it is a bold step forward in greening PNG’s financial sector and will mobilize green investment opportunities to address climate change impacts to ensure a more resilient future for Papua New Guineans. “In line with the Government’s mandate, the Green Finance Centre will strongly advocate for banks to channel loan investments in sectors such as Agriculture, Energy, SMEs and Bioeconomy to promote low-emission options to reduce our carbon footprint and lead by

example in the region and globally, demonstrating our commitment to addressing climate change impacts,” said Mr. Pomaleu.

BPNG Governor Mrs. Elizabeth Genia echoed BPNG’s commitment to this endeavour. “The Bank of Papua New Guinea is committed to promoting national financial inclusion and the greening of the financial sector and the launch of the Green Finance Centre underscores the commitment of all stakeholders involved to drive sustainable development and address climate change challenges through innovative financial mechanisms,” said Mrs. Genia.

Mrs. Genia also thanked CEFI and GGGI for their tremendous work in developing IGFP and now establishment of GFC.

The New Zealand High Commissioner to PNG, HE Peter Zwart, emphasized that climate change and its impacts are real, and that responsive climate action is increasingly urgent. He said, “The New Zealand Ministry of Foreign Affairs and Trade is proud to provide funding for IGFP and collaborate with the Bank of Papua New Guinea and GGGI in establishing the Green Finance Centre which will play a crucial role in working with financial institutions to mobilize increased green lending and investments in Papua New Guinea.”

The France Ambassador to PNG HE Guillaume Lemoine also emphasized the importance of the initiative giving similar remarks saying “Greening the financial system in PNG is crucial towards the fight against climate change and I am proud that France is happy to help PNG tackle this. PNG is a role model in the Pacific, and we wish all the best to the team involved.”

Other VIPs that also spoke during the occasion were AFI Executive Director Dr Alfred Hannig, AFD Executive Director Mr. Philippe Orliange and BPNG Assistant Governor Mr. George Awap who all highly commended the significance of the Green Finance Centre.

The Inclusive green finance initiative is in line with BPNG – CEFI’s Third National Financial Inclusion Strategy (NFIS 3) (2023-2027) and PNG’s climatic goals stated in PNG Vision 2050 and Medium-Term Development Plan IV (2023-2027). The GFC is located within the CEFI office on Level Three, Credit Corp Building, Downtown Port Moresby. For more information on GFC, kindly visit GFC’s website, www.gfcpng.com or send an inquiry to infor@gfcpng.com